No products in the cart.

Return To ShopContribution Margin Managerial Accounting

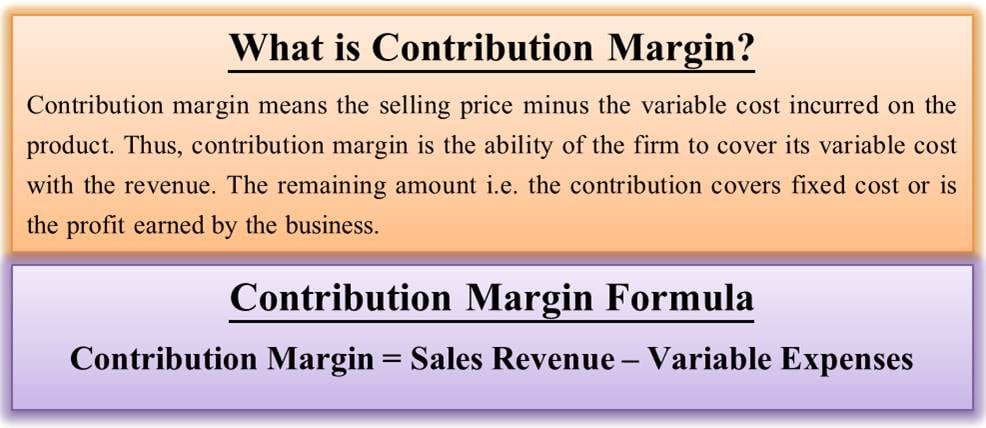

The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good. This is one of several metrics that companies and investors use to make data-driven decisions about their business. As with other figures, it is important to consider contribution margins in relation to other metrics rather than in isolation.

Example: contribution margin and target profit

Whether you sell millions of your products or 10s of your products, these expenses remain the same. Fixed and variable costs are expenses your company accrues from operating the business. To illustrate how this form of income statement can be used, contribution margin income statements for Hicks Manufacturing are shown for the months of April and May. A university van will hold eight passengers, at a cost of \(\$200\) per van. If they send one to eight participants, the fixed cost for the van would be \(\$200\). If they send nine to sixteen students, the fixed cost would be \(\$400\) because they will need two vans.

Variable cost

They immerse themselves in historical data, searching for patterns that reveal how costs have responded to activity changes in the past. Some use statistical tools like regression analysis to quantify these relationships more precisely. The key is to focus on the relevant range of activity levels where cost behavior remains relatively stable and predictable. By doing so, executives and managers can make educated decisions that drive profitability and sustainable growth.

Do you own a business?

Accordingly, the Contribution Margin Per Unit of Umbrella would be as follows. Fixed costs are costs that are incurred independent of how much is sold or produced. Buying items such as machinery is a typical example of a fixed cost, specifically a one-time fixed cost. Regardless of how much it is used and how many units are sold, its cost remains the same. However, these fixed costs become a smaller percentage of each unit’s cost as the number of units sold increases. Variable expenses directly depend upon the quantity of products produced by your company.

How to calculate contribution margin

Weighted average contribution margin per unit equals the sum of contribution margins of all products divided by total units. Weighted average contribution margin ratio equals the sum of contribution margins of all products divided by total sales. Understanding the distinction between fixed and variable costs is crucial for managers looking to make informed decisions and drive profitability. Fixed costs — such as rent, insurance and salaried employees — remain constant regardless of how much a business produces or sells.

- Let’s take another contribution margin example and say that a firm’s fixed expenses are $100,000.

- Soundarya Jayaraman is a Content Marketing Specialist at G2, focusing on cybersecurity.

- Profit is any money left over after all variable and fixed costs have been settled.

- If the company’s contribution margin ratio is higher than the basis for comparison, the result is favorable.

- Fixed costs are the costs that do not change with the change in the level of output.

- Analyzing the contribution margin helps managers make several types of decisions, from whether to add or subtract a product line to how to price a product or service to how to structure sales commissions.

It also helps management understand which products and operations are profitable and which lines or departments need to be discontinued or closed. The contribution margin is affected by the variable costs of producing a product and the product’s selling price. Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits. To master cost-behavior analysis, business leaders employ a variety of techniques.

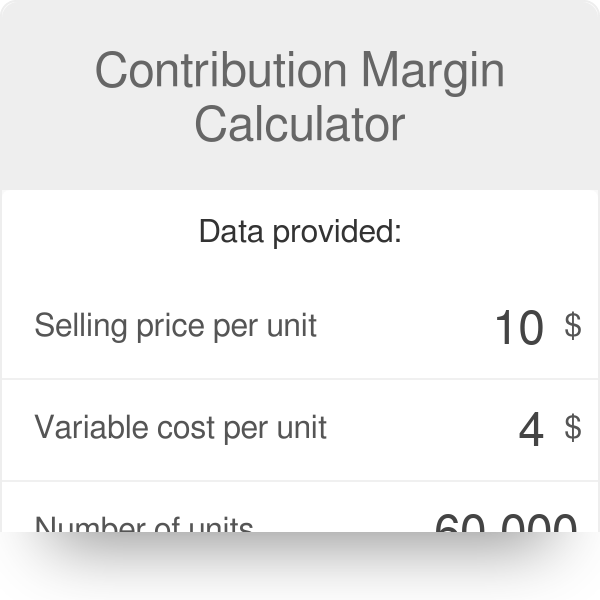

The sales price is $80, variable costs per unit is $50 and fixed costs are $2,400,000 per annum (25% of the which are manufacturing overhead costs) . Once you have calculated the total variable cost, the next step is to calculate the contribution margin. The contribution margin is the difference between total sales revenue and the variable cost of producing a given level of output. The Indirect Costs are the costs that cannot be directly linked to the production. Indirect materials and indirect labor costs that cannot be directly allocated to your products are examples of indirect costs.

Contribution margin may also be expressed as a ratio, showing the percentage of sales that is available to pay fixed costs. The calculation is simply the contribution margin divided by sales. Gross margin is the difference between revenue and the cost of goods sold (COGS).

Where C is the contribution margin, R is the total revenue, and V represents variable costs. The contribution margin can be stated on a gross or per-unit basis. It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm’s services costs. Let’s say we have a company that produces 100,000 units of a product, sells them at $12 per unit, and has a variable costs of $8 per unit. An important point to be noted here is that fixed costs are not considered while evaluating the contribution margin per unit.

Contribution margin is the dollar sales amount available to apply (contribute) toward paying fixed costs during the period. In addition, whatever is left over after all fixed costs have been covered is profit, so contribution margin also contributes to profit—specifically, what we call operating income. A company’s contribution margin is significant because it displays the availability of the revenue after deducting variable costs such as raw materials and transportation expenses.

Thus, it will help you to evaluate your past performance and forecast your future profitability. Accordingly, you need to fill in the actual units of goods sold for a particular period in the past. However, you need to fill in the forecasted units of goods to be sold in a specific future period.

Add comment

You must be logged in to post a comment.